- Be Honest

Kids are so observant and naturally curious. They will openly ask questions about money (Why is that person homeless? Are we rich? Why can’t I have…..?) and sometimes as parents we struggle with how to answer these questions appropriately. In his book, The Opposite of Spoiled, Ron Lieber talks about this very thing and how giving vague answers results in kids who grow up to not know much about the realistic costs of things or how to manage money. When your child asks a question, he advises asking them why they want to know so you can figure out the root of the question (is it anxiety or just pure curiosity) and then you can better answer the question with an honest and down to earth answer. (http://ronlieber.com/books/the-opposite-of-spoiled/

2. Read Books about Money Together

The younger children are exposed to the concept of money and its value, the more likely they will be to make smart money decisions by the time they reach college. This is my opinion based on many discussions with people about their experiences making money decisions, both during and right after the college years. There are so many books on this topic! Some are popular books like Dr. Seuss and Berenstain Bears and then there are books like Alexander, Who Used to be Rich Last Sunday, Smart Girl’s Guide to Money, and If You Made a Million. There are also plenty of books for parents to read for guidance such as The Opposite of Spoiled by Ron Lieber and Smart Money, Smart Kids by Dave Ramsey and Rachel Cruze.

3. Teach Them Delayed Gratification

This is such a hard concept for kids to grasp. Waiting is soooo hard for their little attention spans. It is however such an important life lesson that will do them well financially. Spending money on impulse or to make you feel happy leads to poor money choices. Those expenses often go on credit cards or aren’t budgeted into the monthly budget and therefore take you off track financially.

4. Think About How You Want to Answer Money Questions

What answer or reason do you currently give when they ask for something you know you aren’t going to buy them? Do you say you can’t afford it when you really can but just don’t think they need it? Do they compare your lifestyle to those of their friends? How do you answer those questions? Does parental guilt about your own money choices lead how you answer? Think through how you want to answer those questions and how your answer will impact their view of money. It’s ok to get back to them with an answer later.

5. Talk About Choices (Wants Versus Needs)

As adults we can see that the Mr. and Mrs. Jones are up to their eyeballs in debt to meet the status quo or that they have an education or skill set that allows them to afford that status. Talk to your children about the different choices people can make regarding money (without pointing out specific people of course). Help them see the difference between our basic needs and things we want but don’t have to have. Talk to them about the costs of different houses, cars, etc and what it takes to afford those things without going into a huge amount of debt. Talk to them about options such as saving a decent size down payment for a house or car and then taking a loan that is a less amount of time than the traditional route so they can pay it off faster. Teach them about compounding interest and how that looks for various credit card and loan options. Give them all the facts so they can make the smart choices.

6. Teach Them ways to Earn Money

I don’t pay my child to do chores and I don’t believe in allowance. Why? It’s not realistic. No one paid me to make my bed this morning or do my dishes. It’s a part of being in a family or community. We all have to pitch in. Instead, help them find their entrepreneurial spirit and use their skills to make money. If you don’t have a way to do this, another idea is to pay them to read books and articles that you choose. This shows them that gaining more education or skills equals pay which is a realistic life scenario.

7. Once They are Earning Money, Teach Them What to do With it (Set Goals)

Kids who learn early that money is a tool that can be used to make additional money will be set once they are adults. I have asked many people what they wish they knew by the time they got to college and they all say they wish they were taught to manage their money as a tool. Kids should know that they can’t spend every dime they make and should get in the habit of saving and investing some as well as being generous and giving some away too. Help them set obtainable short and long term goals with their money.

8. Teach Them that Money is a Limited Resource

We teach kids that things like water and clean air are limited resources and that we have to take care of our planet and recycle etc to continue to have this resource available to us. The same thing goes for money. When I talk to kids about money I joke about having a money tree in my front yard I can go to when I need to buy something. I can just pick money off that tree and go to the store or on vacation. They of course think this is funny and ridiculous, but it puts the concept of money being a limited resource into perspective. In reality we work hard to earn money and once we have it we should be careful how we spend it.

9. Help Them Assign a Job to Each Dollar They Earn

If you have ever listened to Dave Ramsey, you have heard this on repeat. Just like the saying about idle hands, idle money is just as dangerous and wasteful. Giving each dollar a job reinforces that it is a limited resource that can be used as a tool for not only our needs but also our wants and dreams if we assign it correctly. You can do this by setting a percentage of what they earn to go towards what they can spend in the moment, what they need to save, what they should invest, and what they should give. (https://www.daveramsey.com/store/product/smart-money-smart-kids-book-by-dave-ramsey-and-rachel-cruze)

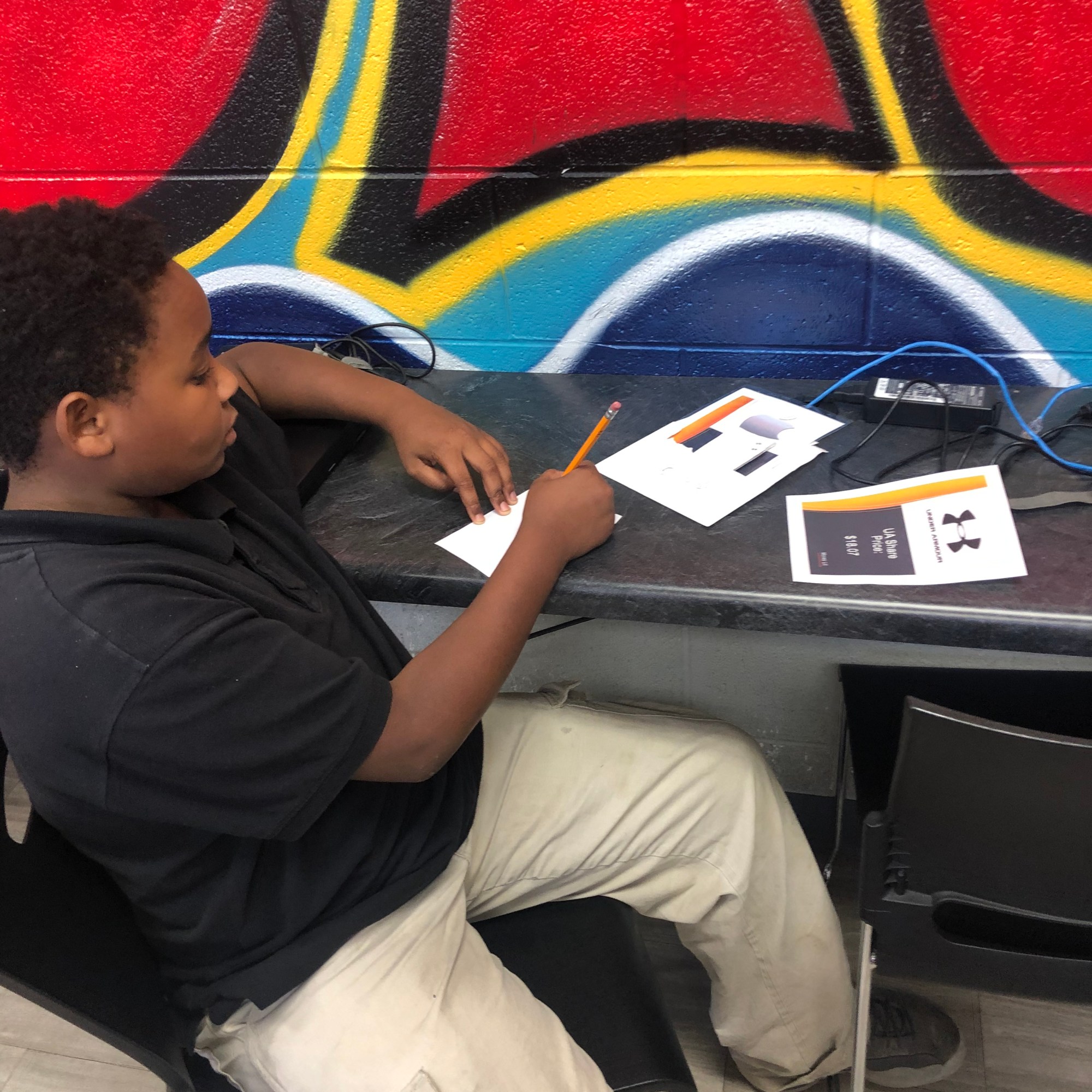

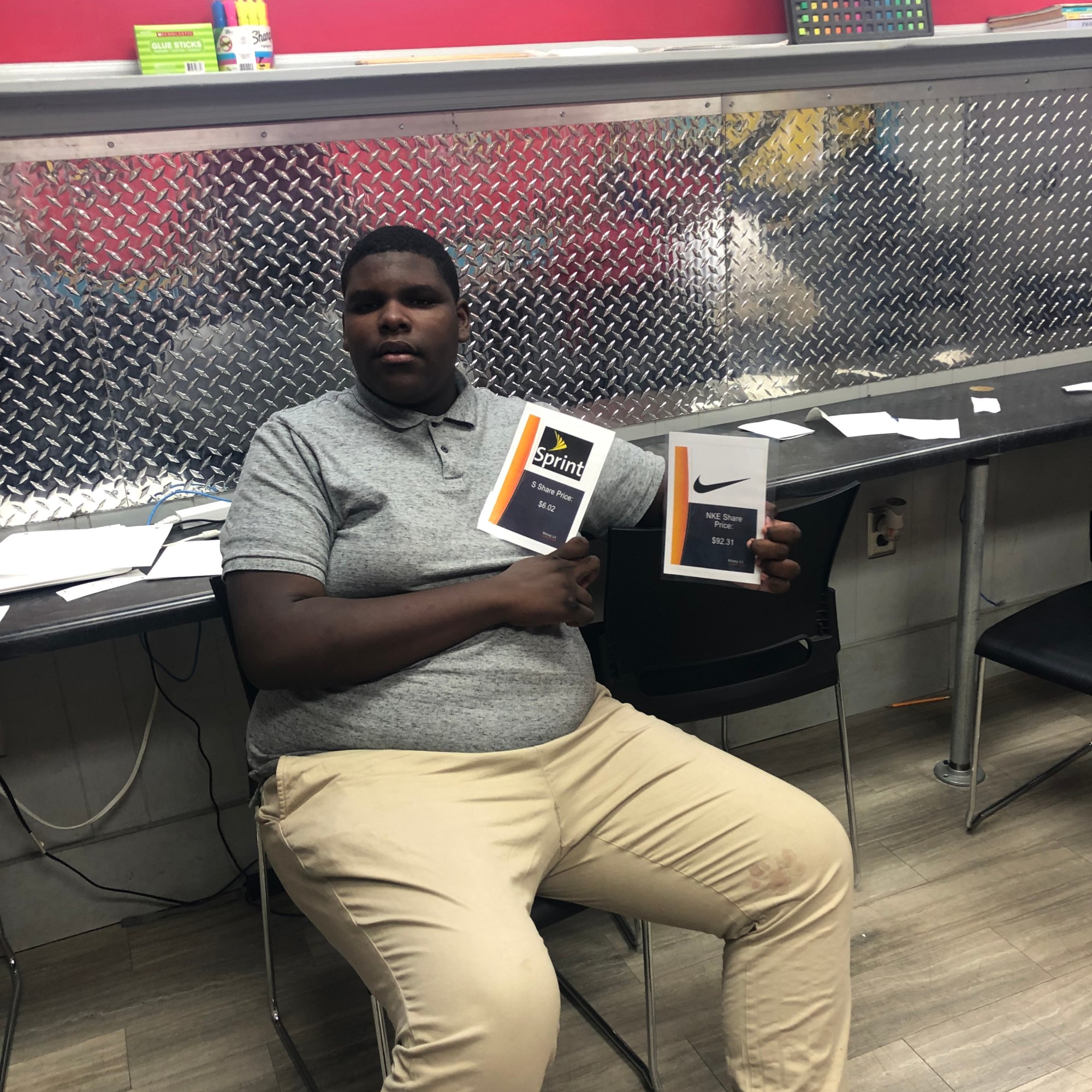

10. Use Apps to Teach Investing

Apps like Stockpile teach children the basics of researching, buying, and selling stocks by allowing them to invest in a small part ($5) of bigger stocks like Amazon, Tesla, etc. They can see how the stock is doing in real time while only investing in $5 increments. Have them research the stocks and compare competitors to see which the better choice is. The app provides news articles on each as well. When they decide to buy or sell, you will be sent an alert and asked if you want to give them permission to do so. (https://www.stockpile.com/)